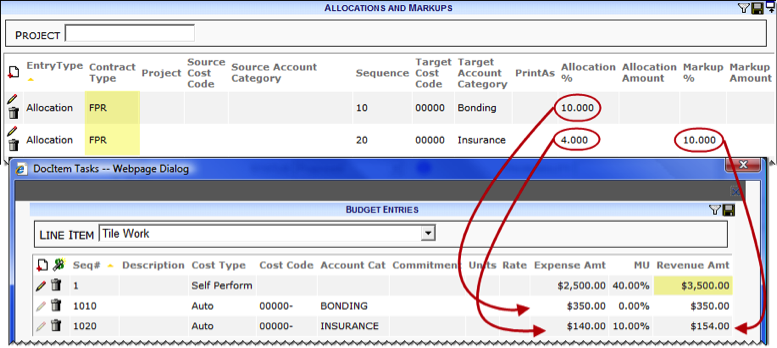

Examples of Allocations

You have a Project Setup with a Contract Type of Fixed Price to Rev (FPR). On a Change Order you open the Budget Entries window from an Item and add a Self Perform entry with an expanse amount of $2500 and a revenue amount of $3500. You then click the Allocations icon. Using the Allocations set up as shown below, the following would be the result. Because the Contract Type is FPR, both Allocations for FPR would apply, one adding 10% of the revenue as an expense amount, and the other adding 4% of the revenue as an expense amount with an additional 1% markup for revenue.

Now you have a Project Setup with a Contract Type of Cost Plus to Rev (CPR). You create a Change Order with a Change Item. On its Budget Entries window, you create a Commitment of $1000. You also add a Self-Perform entry for Materials for $400 with a 25% markup, equaling $500 in revenue. When you click the Allocations icon, you receive the following results. All Allocations for the CPR Contract Type are considered for these Budget Entries. Because the Self-Perform entry has a Cost Code of 02000 and an Account Category of Materials – Permanent, the “Stock Fee” Allocations and 2% markup apply to it. The other CPR Allocations with a Sequence number under 100 (Bond Fee and Mgmt Fee) are applied to $1500; other CPR Allocations with a Sequence number 100 or higher (Insurance and BO Tax) are applied to the sum of all previous revenue amounts ($500+$1000+$180+$76.50+$225).

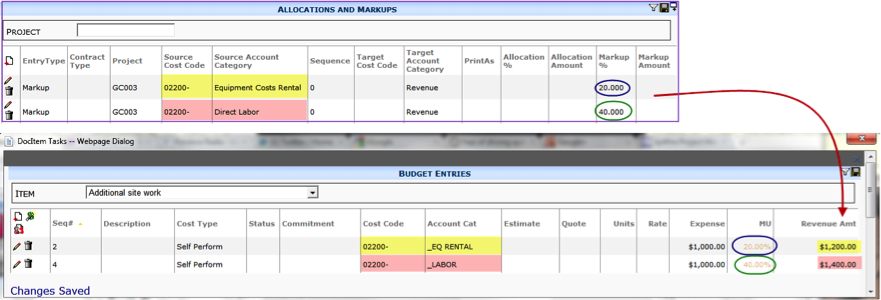

Example of Markups

In this example, you want Budget Entries with a Cost Code of 02200 and an Account Category of _EQ RENTAL (Equipment Costs Rental) to be marked up to 20% and Budget Entries with a Cost Code of 02200 and an Account Category of _LABOR (Direct Labor) to be marked up 40%. After you set these markups up. the amounts are calculated automatically on the Budget Entries window.