You can choose to release retention at final billing or at a later date. During the final billing process, the calculation of sales tax (if any) becomes more complex because of these two ways to process final billings.

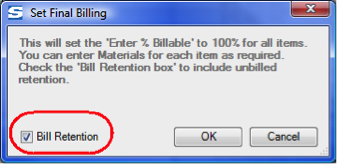

Released at Final Billing

If this mode, Bill Retention is checked.

The To Date % column will be set to 100% for all SOV line items that are not yet at or above 100%. This action causes the work amounts in the Application to equal the SOV amount less previous billing amounts but retention is NOT calculated on these new amounts.

At this time, sales tax (if any) is calculated ONLY on the applicable new work or material amounts not the prior retention amounts. Acquiring an invoice number would result in an amount equal to the new work an the new work sales tax.

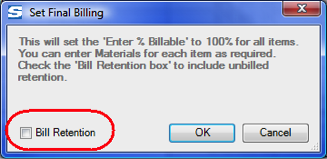

Released at a Later Date

In this mode, the Bill Retention is not checked.

The To Date % column will be set to 100% for all SOV line items that are not yet at or above 100%. This action causes the work amounts in the Application to equal the SOV amount less previous billing amounts and the retention to increase as it would if the work complete amounts was entered manually. The sales tax is calculated on the total amounts in the Work Completed and Stored Materials columns.

At this point you can acquire an invoice number.

At a later time, you would create the next Pay Application from this current Pay Application document and you would check the Bill Retention checkbox for final billing, causing the retention amounts to be moved to the Total column. The sales tax (if any) would be set to zero because sales tax was already billed. Acquiring an Invoice number would then result in a zero amount invoice.