Question:

A) When I select the SOV Print option on my Pay Application SOV workbook, I get the following message. What does it mean and what should I do before I invoice?

Sum of Retention Adjustment: The sum of the retention by rows DOES NOT equal this Application Amount multiplied by the retention percent. Manual Pennies Adjustment may be required.

B) When I try to Acquire Invoice on the SOV workbook I get the following message. How do I continue in order to invoice?

Amounts do not match. This is probably a rounding error.

Answer:

Either of these messages can appear when you select the SOV Print or Acquire Invoice options in the SOV workbook. The message indicates that, because of rounding discrepancies, certain amounts on the SOV workbook that should match do not, thus affecting your Current Payment Due. Often the discrepancy is only a penny or two.

What can happen on the SOV workbook is that, as you enter amounts in the To Date % or Work Completed column, Microsoft Excel uses internal currency rounding rules to determine other corresponding amounts.

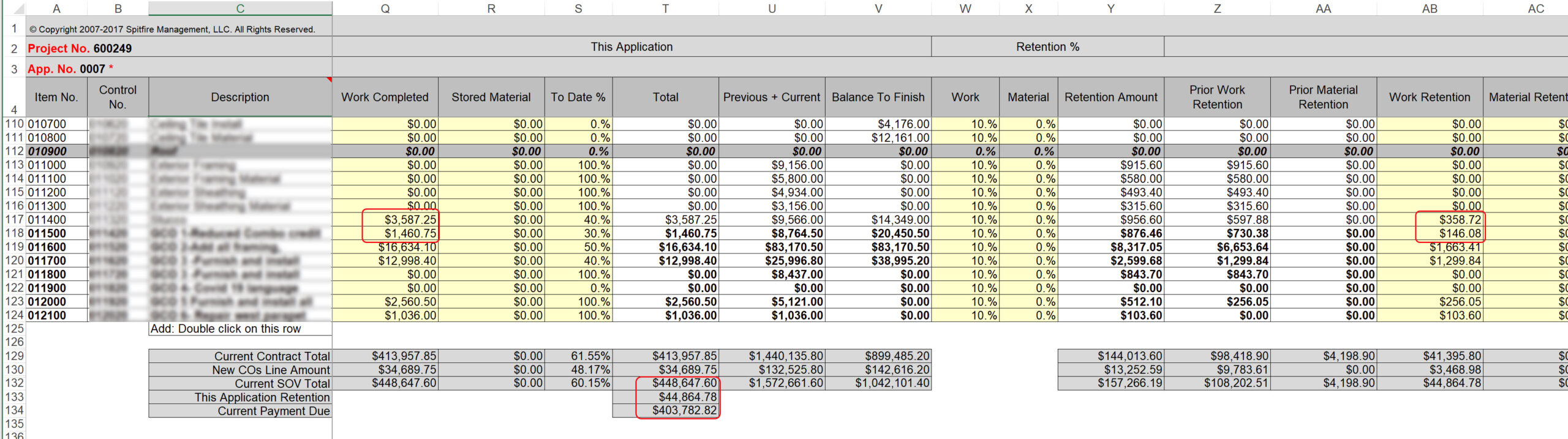

For example, on row 117 below, the 10% retention for $3587.25 is down as $358.72, but it could also have appeared as $358.73. Likewise, on row 118 below, the 10% retention for $1460.75 is down as $146.08, but could have otherwise appeared as $146.07.

These half cents can add up. You will notice that, in the example above, the total retention is $44,864.78 even though 10% of the SOV total ($448,647.60) should be $44,864.76.

To manually change the Application Retention:

- Find a row with cents that end in 5 and adjust the Work Completed or Work Retention amount by one penny (either more or less).

- Save, then check your totals.

- Try the SOV Print or Acquire Invoice option again. If there is still a discrepancy the message will reappear. If all numbers match up, it won’t.

- If you need to make another adjustment, find another row and manually change that amount by one penny. Continue until all your amounts are as you expect them to be.

KBA-01806; Last updated: August 30, 2022 at 16:16 pm