Questions:

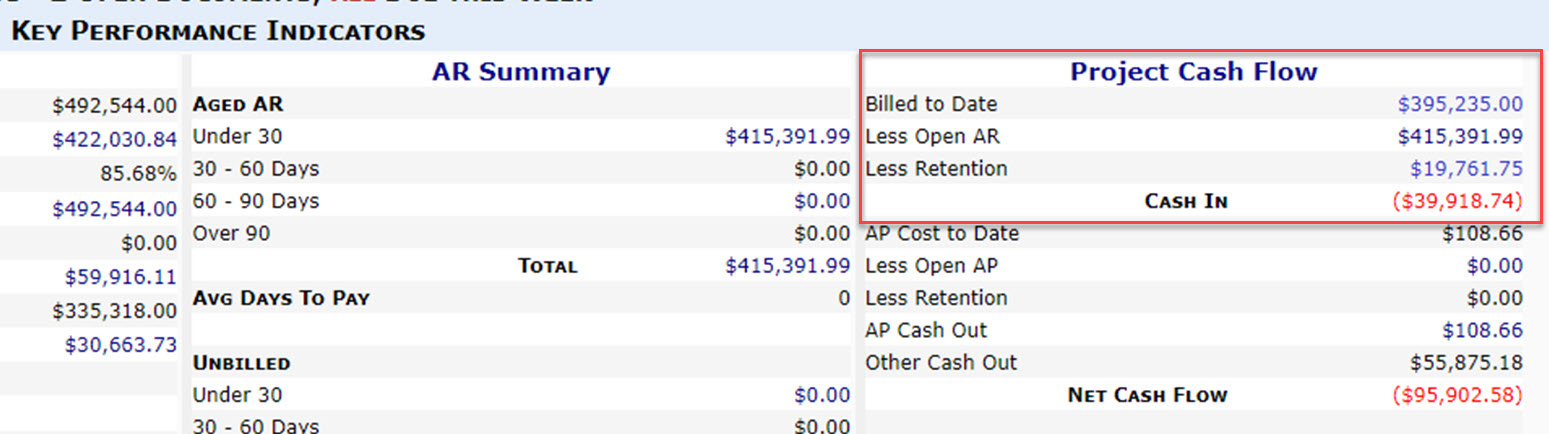

- Why is “Less Open AR” on my project KPI higher than my “Billed to Date”?

- Why is “Less Open AR” on my project KPI greater than I expected?

- Why is the “Cash In” total on my project KPI less than the amount of cash we have actually received?

Answer:

Odds are that your project has sales tax and some open AR. This seeming discrepancy is most noticeable on newer projects. The reason this happens is because total AR is inflated by the sales tax, but Billed to Date excludes that tax.

When a project has sales tax, the tax due is part of your accounts receivables, but that amount is not included in the Billed to Date because it is not revenue for the project; it is actually a liability that is due to your tax authority. Cash In is calculated as the Billed to Date amount minus the sum of the total AR plus retention. When the total AR is greater than the Billed to Date (because of the amount of tax due), Cash In will be reduced by the amount of the tax liability.

This makes sense when you consider that (under accrual accounting), your liability to the tax authority may have to be paid before you receive the payment on the Open AR.

KBA-01830; Last updated: June 28, 2022 at 15:39 pm