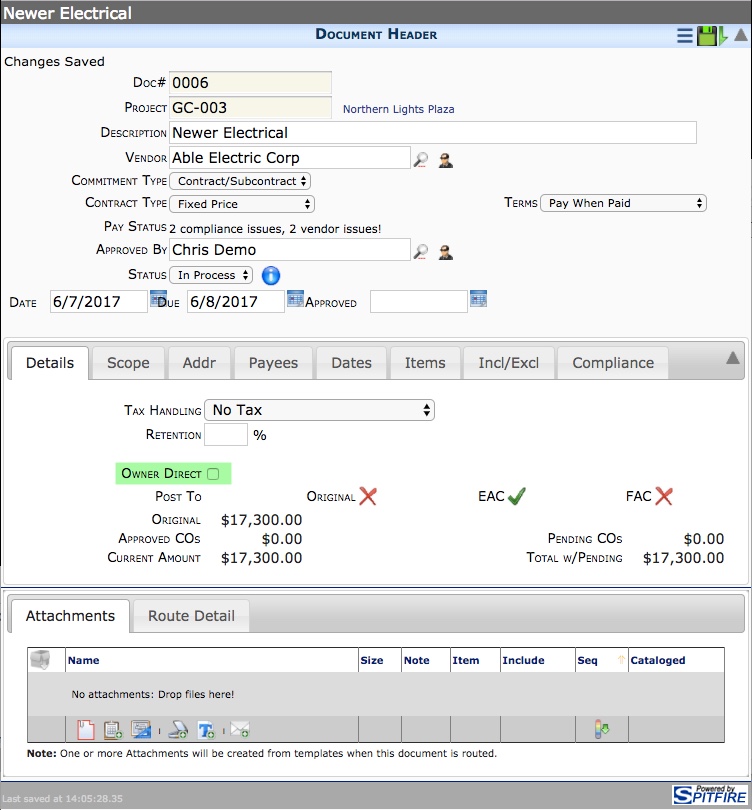

The Commitment document contains information on the contracts you have with vendors and subcontractors and, optionally, suppliers (purchase orders).

When used at non-integrated sites, Owner Direct is purely informational. However, when using at integrated sites, selecting Owner Direct will prevent the Commitment (and its associated Pay Requests) from being exported to the accounting system.

A project can have any number of Commitments of different subtypes. Commitments can be created from RFQs when they are part of a Bid Package – RFQ – Commitment workflow, and they can also be created from Change Orders. Compliance tracking is tightly intertwined with Commitments. Once Committed (approved), Commitments require CCO documents for any changes made to the Commitment Items. Commitments can update the budget, are linked to Pay Requests and Receipts.

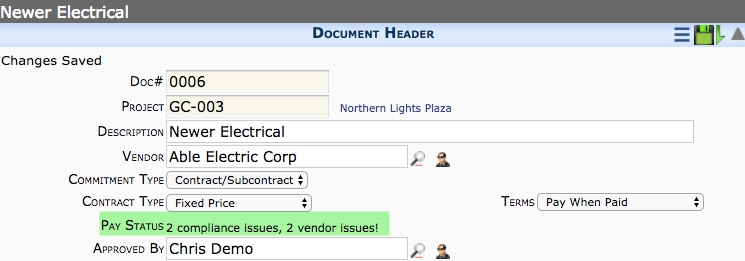

Pay Status

Pay Status informs you of compliance issues. You cannot edit this field.

If the Commitment is in-compliance, the message will read “in compliance”. If the Commitment is out of compliance, the message will indicate the number of issues. If the Vendor is out of compliance, the message will indicate the number of issues.

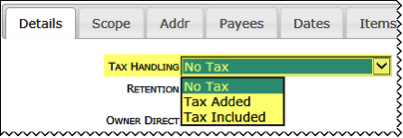

Optional Tax/Freight Handling

Commitment documents can be configured to track how remitted sales tax is handled. The Tax Handling drop-down list on the Details tab indicates a default you can override.

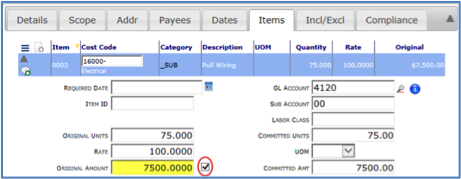

Commitment Item Caps

Commitment Items can be capped so the corresponding Item on a Pay Request cannot exceed the Item amount.

When Cap is not selected, sfPMS does allow the corresponding Item on a Pay Request to exceed the amount but displays a warning when the Pay Request document is saved.

Compliance Tab

By default the Commitment Doc Type includes the Compliance tab, where compliance requirements are tracked for the specific Commitment against the Commitment’s Start and Finish dates, Commitment amount, and percent paid.