Form Navigation

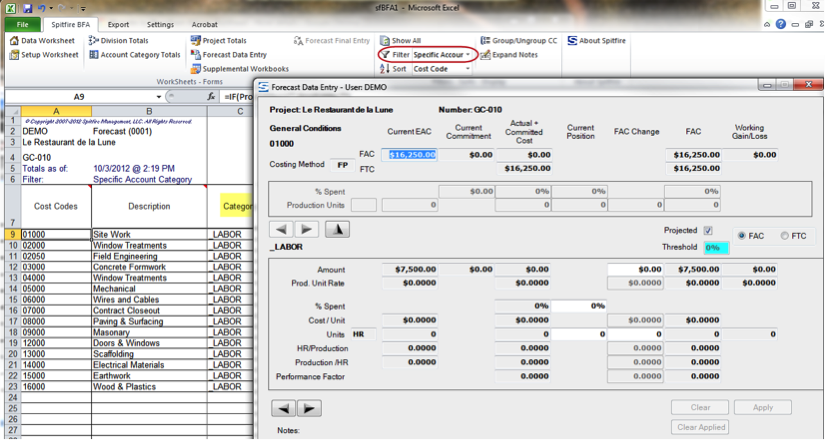

By default the BFA Data worksheet (and therefore the Forecast Data Entry form) is organized by Cost Codes. The navigation buttons allow you to move from Cost Code to Cost Code and from one Account Category to the next within Cost Codes.

However, if you display the Category column in the BFA workbook and filter by Specific Account Category before opening the Forecast Data Entry form, the bottom navigation buttons will move from Cost Code to Cost Code.

Form Sections

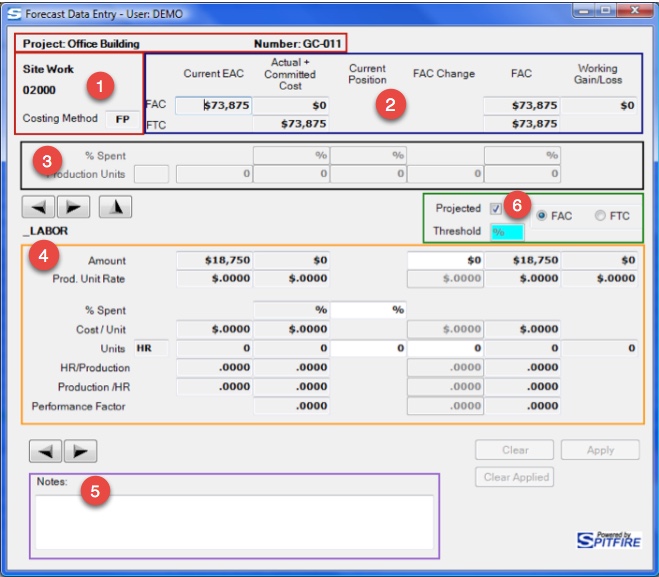

A closer look at the form in the Account Category View with Units version reveals the sections found in all the Forecast Data Entry forms.

Additional areas supply information and navigation support.

| Area 1 | The top left-hand corner shows the Project Name, Project Number, Cost Code description, and Cost Code ID. It also shows the Costing Method. |

| Area 2 | Two rows—Forecast At Completion (FAC) and Forecast to Completion (FTC)—display column data: The column headings (Current EAC, Actual + Committed Cost, etc.) apply through to the bottom of the form. You can make changes to the Current Position and FAC Change columns. |

| Area 3 | The top outlined box focuses on Cost Code- specific information and possible forecast changes. Enter % Spent or Production Units in these rows. |

| Area 4 | The bottom outlined box focuses on Account Category-specific information. In the Cost Code View, only summary information is presented in this grid. The Account Category View displays all possible forecast changes. |

| Area 5 | The Notes area allows you to enter freeform notes. Also, system notes appear here. |

| Area 6 | This area is reserved for additional information related to Cost Code and Account Category, which include Projected and Threshold. |

| Current EAC | Current Commitment | Actual + Committed Cost | FAC | Working Gain/Loss | |

| Cost Code Level | |||||

| FAC | Sum of Account Category EAC | Sum of Current Commitment s | Sum of Account Category Actual + Committed | Sum of Account Category FAC | Cost Code EAC – Cost Code FAC |

| FTC | FAC – Sum of Account Category Actual + Committed | FAC – Sum of Account Category Actual + Committed | |||

| ACCOUNT CATEGORY LEVEL | |||||

| Amount | Data sheet EAC (B) | Data sheet Current Commitments | Data sheet Actual + Committed (A) | Projected FAC | FAC Cost Code Units * Production Unit Rate Gain/Loss |

| Prod. Unit Rate | Account Category EAC Amount/ Cost Code Units | Account Category Actual + Committed / Cost Code Actual Units | FAC Amount / Cost Code Actual Units | EAC Production Unit Rate – FAC Production Unit Rate | |

| % Spent | (A) / (B) | ||||

| Cost/Unit | Data Sheet Composite Rate Account Category Amount / Units | Account Category Amount / Cost Code Actual Units | FAC Account Category Amount / Cost Code Actual Units | ||

| Units | Data Sheet Account Category EAC Units | Data Sheet Account Category Actual Units | FAC Projected Hrs | (EAC Hours / Units) – (FAC Hours / Units) | |

| HR / Production | Data Sheet Account Category Units / Cost Codes Units (e.g., Units /Hours) | Data Sheet Account Category Units / Cost Codes Units (e.g., Units /Hours) | FAC Account Category Units / Cost Code Units | ||

| Production / HR | Data Sheet Cost Codes Units / Account Category Units (e.g., Hours / Units) | Data Sheet Cost Codes Units / Account Category Units (e.g., Hours / Units) | (EAC Hours / Units) / (FAC Hours / Units) | ||

| Performance Factor | EAC Sum of Account Category Labor Hrs / Cost Code Units | FAC Sum of Account Category Labor Hrs/ Cost Code Units |

Form Options

Projected Checkbox

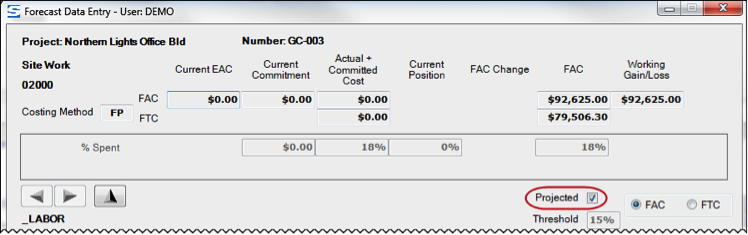

While on the Account Category row, you can toggle the Projected flag. This setting will be preserved when you save. If the Projected checkbox is clear (not checked), the Account Category is flagged not to project. As such, the FAC will be set to the greater of the EAC or Actual plus Committed.

If the Projected checkbox is checked, the forecast calculation engine is enabled for this Cost Code/Account Category. The forecast calculation engine uses industry standard algorithms to approximate the amounts and unit required to finish the project. These results are presented as either Forecast At Completion (FAC) or Forecast To Completion (FTC) amounts. Critical to the calculations are the Costing Method, the Cost Code’s current percent complete, and the Actual plus Committed cost. The forecast calculation engine is suppressed until the Actual plus Committed cost have met or exceeded the Threshold.

Threshold

Cost Codes must pass the Threshold (where the Actual plus Committed cost is greater than the Revised EAC times the Threshold) before the worksheet will use the appropriate calculation to generate the FAC. (Otherwise, the maximum of EAC or Actual plus Committed will be used.) The Threshold field has a blue background if the Cost Code is below the Threshold. While on a Cost Code, you can type in the Threshold field to alter the Threshold. Changes will trickle down to the constituent Accounts Codes. All changes will be preserved when you save.

The default threshold is established during implementation. You can override the default threshold in your Import Budget template. (See also KBA-01240.)

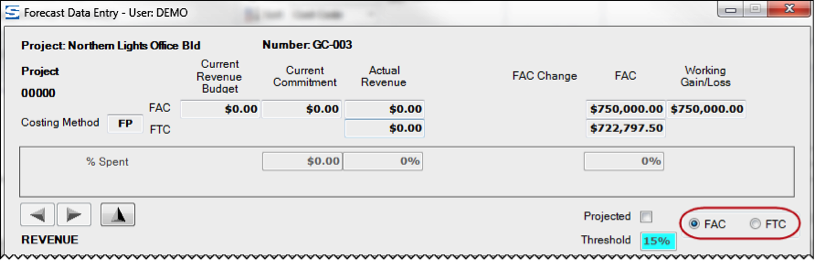

FAC vs. FTC

The FAC (Forecast At Completion) vs. FTC (Forecast To Completion) option indicates if your entry in the Change columns is a FAC and FTC value.

Note: FAC is the value at completion, whereas FTC is the value required over and above the current Actual plus Committed amount in order to see the project through to completion.