The addition of sales tax to a project offers the ability to automatically calculate, display, print, and post the applicable sales tax while creating each SOV application.

The tax calculation is based on the total Application amount and the tax rate are entered on the Project Setup or Pay Application document. You can also choose to manually change an existing tax amount for the application directly on the SOV Application worksheet. Once you switch to manual tax entry, the SOV workbook will expect manual tax information and will not use the defaults established in the Project Setup and Pay Application documents to calculate a tax amount, until and unless you choose to go back to automatic tax entry.

To enter sales tax manually:

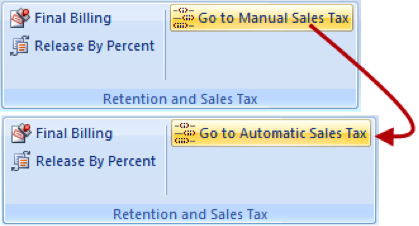

- On the Spitfire SOV ribbon, toggle the Go to Manual Sales Tax option to switch to Go To Automatic Sales Tax.

- Type in the application’s tax basis and/or amount in the cell(s).

As you enter information on the Application worksheet, sales tax is calculated for total work, materials, and retention. The following diagram shows where tax information appears on the Print Summary/SOV Print form.